Perseus Mining Delivers Record Financial Results and Capital Returns

Perth, Aug. 28, 2025 (GLOBE NEWSWIRE) -- PERSEUS DELIVERS RECORD FINANCIAL RESULTS & CAPITAL RETURNS

Perth, Western Australia/August 28, 2025/African focused gold producer Perseus Mining Limited (ASX/TSX: PRU), has released its Annual Report for the financial year ending 30 June 2025 (FY25), including both its Annual Financial Report and Sustainability Report.

highlights1

financial performance

- Profit after tax (PAT) of US$421.7 or A$651.0 million (up 16%)

- Earnings based on Revenue of US$1.248 (A$1.927) billion (up 22%), Earnings before interest, tax, depreciation and amortisation (EBITDA) of US$740.3 (A$1,142.8) million (up 18%).

- Basic earnings per share (EPS) of US$0.270 (A$0.417) (up 14%) resulting in an earnings yield of 11.3% and a price: earnings (P/E) ratio of 8.84.

- Net cash flow from operating activities of US$536.7 (A$828.4) million (up 25%) or US$0.3912 (A$0.604) per share resulting in a price: operating cashflow (P/OCF) ratio of 6.13.

- Net tangible assets (NTA) of US$1.9 (A$2.9) billion or US$1.40 (A$2.14) per share.

-

US$826.5 (A$1,261.5) million of cash and bullion (A$0.92 per share) and zero debt.

-

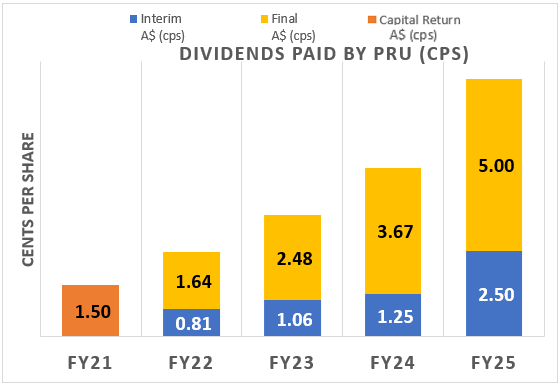

Final dividend of A$0.05 per share for FY25, making a total dividend for FY25 of A$0.075 per share, 50% more than in FY24. This final dividend equates to a dividend yield of 2.1%3.

- Perseus’s share buyback programme to be renewed, with up to A$100 million to be invested in a further on-market share buy-back programme of Perseus’s shares over the next a 12-month period.

1. % increases referenced against Financial Year end 30 June 24 (FY24)

2. Operating cash flow per share is calculated as net cash inflows from operating activities divided by weighted average number of outstanding ordinary shares

3. Dividend yield, as well as P/E and P/OCF ratios are based on Perseus’s 20-day volume weighted average price (VWAP) at 30 June 25 of A$3.644 per share or US$2.388 converted at the close rate of 0.6552

Sustainability performance

- Total economic contribution of ~US$813 million to our host countries, including Tanzania and Sudan

- Strong safety performance with Total Recordable Injury Frequency Rate (TRIFR) of 0.60 and Lost Time Injury Frequency Rate (LTIFR) of 0.08.

-

94% local employment and 88% local procurement

-

US$5.6 million in community contributions in Côte d’Ivoire and Ghana

- Zero significant environmental event and relatively stable emissions intensity at 0.56t CO2e per ounce of gold produced

Perseus’s Managing Director and CEO, Jeff Quartermaine said:

“The record financial results that Perseus has delivered this financial year reflect a continuation of both elevated gold prices and our strong, consistent operating performance at all levels of our business throughout the year.

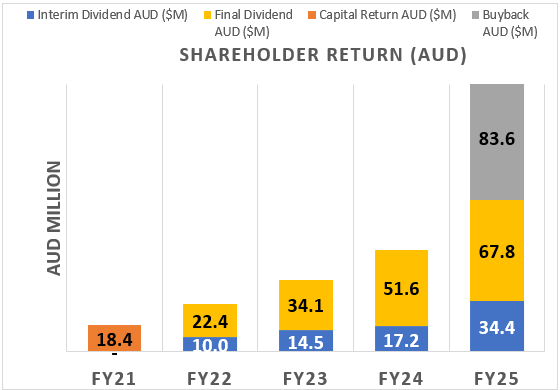

Since our maiden dividend distribution in August 2021, Perseus has to date, returned A$286.1 million to our shareholders via a combination of dividends and share buybacks. Given our strong financial performance in FY25, our Board has decided to increase capital returns to shareholders by declaring a final dividend of 5 Australian cents per share, bringing the full FY25 dividend to 7.5 Australian cents per share, 50% more than last year. We have also decided to continue our programme of buying back shares by investing a further A$100 million in share buy backs over the next 12 months.

In determining the quantum of these capital returns, we have carefully considered our considerable cashflow generating capacity as well as the capital investment programme that lies ahead for Perseus as we develop both the Nyanzaga Gold Project in Tanzania, and the CMA Underground Project at our Yaouré Gold Mine in Côte d’Ivoire.

We are also mindful that in addition to investing in the future growth of our Company, we need to invest in our social licence to operate by continuing our current practice of contributing materially to the economies of our host countries and host communities and paying fair salaries to our local and expatriate employees who have delivered these outstanding results.

Having achieved our corporate mission of generating material benefits for all of our stakeholders, in fair and equitable proportions in FY25, we are looking forward to continuing to operate in this manner for many years to come.”

fy25 financial performance

| UNIT | 30 JUNE 2025 | 30 JUNE 2024 | % VARIANCE | ||||

| Key Financials | |||||||

| Revenue | US$’000 | 1,248,082 | 1,025,799 | 22 | % | ||

| EBITDA4 | US$’000 | 740,312 | 625,240 | 18 | % | ||

| Depreciation and amortisation | US$’000 | (153,805 | ) | (142,382 | ) | 8 | % |

| Profit before tax | US$’000 | 564,444 | 467,103 | 21 | % | ||

| Profit after tax | US$’000 | 421,714 | 364,755 | 16 | % | ||

| Operating cash flow5 | US$’000 | 536,659 | 429,178 | 25 | % | ||

| Cash and bullion6 | US$’000 | 826,527 | 587,193 | 41 | % | ||

| Production | |||||||

| Gold sold | oz | 494,343 | 508,669 | (2.8 | %) | ||

| All-in site cost | US$/oz | 1,235 | 1,053 | 17 | % | ||

| Average gold price realised | US$/oz | 2,543 | 2,014 | 26 | % | ||

4. Gross profit from operations before depreciation and amortisation

5. Net cash inflows from operating activities

6. Including cash, US$752 million and 22,722oz bullion on hand, valued at US$75 million

EARNINGS AND CASHFLOW

The Group recorded a net profit after tax of US$421.7 million for the year, compared to the previous financial year’s net profit after tax of US$364.8 million, representing a US$56.9 million or 16% improvement in performance. This result is based on:

- An increase in revenue resulting from higher gold prices, offsetting the slight decrease in gold production arising from Edikan and Sissingue in FY25.

- An increase in cost of sales due to higher mining costs and higher royalties from an increased gold price, partially offset by slightly lower production during the year relative to FY24.

- An income tax expense of US$142.7 million compared to a US$102.3 million in the prior year due to higher profits at Edikan, coupled with withholding taxes on intercompany dividends paid out of Côte d'Ivoire.

- Depreciation and amortisation expense of US$153.8 million, 8% more than in the previous financial year.

- Increase in other expenses due to once-off restructuring costs of US$18.1 million relating to the transition of Edikan employees from permanent to fixed term contracts; and

- Interest income earned on available cash balances of US$16.1 million, which is a US$4.6 million increase on FY24.

A total of US$536.7 million or 39.57 US cents per share of operating cashflow was generated during the year, contributing to a cash and bullion balance at year-end of US$826.5 million (30 June 2024: US$587.2 million), with no outstanding debt. The increase in cash and bullion during the period was achieved mainly as a result of gold prices.

BALANCE SHEET

At 30 June 2025, the Company’s net tangible assets amounted to US$1,900.5 million, or US$1.407 per share, approximately 52% more than at the end of the prior financial year.

7. Net Tangible Assets per share is calculated as net tangible assets divided by number of outstanding ordinary shares at 30 June 2025

FINAL DIVIDEND & SHARE BUYBACK

The Directors have declared a final unfranked dividend of 5.00 Australian cents per share (A$67.8 million or ~US$44.4 million). Together with the interim dividend of 2.50 Australian cents per share declared in February 2025, this brings the total dividend declared by Perseus in FY25 to 7.50 Australian cents per share, which equates to an annual dividend yield of 2.07%.

Shares will go ex-dividend on 9 September 2025, and the record date will be 10 September 2025 (for TSX shareholders the ex-dividend date and record date will be 10 September 2025). Dividends will be paid to shareholders on 9 October 2025 and are unfranked and declared as Conduit Foreign Income (CFI).

Note: Buyback of A$83.6M includes transactions in FY26, up to the date of this report.

Perseus also continued its programme of buying back shares that commenced in FY25 and at the date of this report had purchased A$83.6 million of ordinary shares. Based on Perseus’s future expected operating and cash flow requirements, the Board has unanimously approved a further on-market share buy-back of up to A$100 million of ordinary shares to commence on or about 24 September 2025 and be completed within 12 months.

In accordance with the ASX Listing Rules, the price paid for shares purchased under the buy-back will be no more than 5% above the volume weighted average price of Perseus shares over the five trading days prior to the purchase. However, the actual price paid is subject to prevailing share price and market conditions and will be executed at the Company’s discretion.

The on-market share buy-back will otherwise be undertaken in accordance with the terms specified in the Appendix 3C released to ASX today. The buy-back will be conducted in the ordinary course of trading over the next 12 months. The final amount of the buy-back and the exact timing of any trades made from time to time will depend on several factors including market conditions, Perseus’s prevailing share price, its future capital requirements and any unforeseen developments or circumstances that may arise in the course of the buy-back.

Accordingly, there is no assurance that Perseus will buy back any or all of the up to A$100 million worth of shares contemplated. Perseus reserves the right to suspend or terminate the buy-back at any time (having regard to the previously mentioned factors and the best interests of Perseus).

The buy-back will fall within the “10/12” limit permitted under the Australian Corporations Act and does not require shareholder approval. The “10/12” limit for a company proposing a buyback is 10% of the smallest number of votes attached to Perseus shares at any time during the past 12 months. Consistent with the requirements of the Corporations Act, the Company will immediately cancel any shares acquired by it under the buy-back.

The Directors of Perseus will not offer any shares into the buy-back.

OUTLOOK for FY2026

Gold production and cost guidance for the financial year ending June 2026 remain unchanged from that previously reported to the market, namely:

| PARAMETER | UNITS |

2026 FINANCIAL YEAR (FORECAST) |

| Yaouré Gold Mine | ||

| Production | Ounces | 168,000 – 184,000 |

| All-in Site Cost | USD per ounce | $1,500 - $1,660 |

| Edikan Gold Mine | ||

| Production | Ounces | 154,000 – 169,000 |

| All-in Site Cost | USD per ounce | $1,420 - $1,570 |

| Sissingué Gold Mine | ||

| Production | Ounces | 78,000 – 87,000 |

| All-in Site Cost | USD per ounce | $1,470 - $1,620 |

| PERSEUS GROUP | ||

| Production | Ounces | 400,000 – 440,000 |

| All-in Site Cost | USD per ounce | $1,460 - $1,620 |

fy25 sustainability performance

Through another year of excellent performance, Perseus improved the TRIFR by 43% on FY24, the lowest in the Company’s history. We remain committed to ensuring every person returns home healthy and safe each day, supported by a strong safety culture built on critical control management, visible leadership, care, accountability, and meaningful safety interactions. This commitment is underpinned by the rollout of our ‘Safely Home Every Day’ initiative and our Fatality Risk Management programme.

We continued to create lasting economic and social value in our host countries and communities, contributing US$5.63 million to our communities in FY25 and spending US$545 million with local suppliers. At our Nyanzaga Gold Project in Tanzania, we extended the same approach to creating social value, by establishing structures and initiatives related to training, local employment and community engagement.

We endorsed several initiatives and outcomes to strengthen our governance and delivery of sustainability outcomes. These included updates to sustainability-related policies, the completion of a double-materiality assessment and strategic review of the outcomes to inform Perseus’s updated Sustainability Strategy.

This announcement was approved for release by the Board of Perseus Mining Limited.

Competent Person Statement

All production targets referred to in this report are underpinned by estimated Ore Reserves which have been prepared by Competent Persons in accordance with the requirements of the JORC Code.

The information in this report that relates to the Mineral Resources and Ore Reserve was updated by the Company in a market announcement “Perseus Mining updates Mineral Resources and Ore Reserves” released on 21 August 2025. The Company confirms that all material assumptions underpinning those estimates and the production targets, or the forecast financial information derived therefrom, in that market release continue to apply and have not materially changed.

The Company confirms that the material assumptions underpinning the estimates of Ore Reserves described in “Technical Report — Edikan Gold Mine, Ghana” dated 6 April 2022, “Technical Report — Yaouré Gold Project, Côte d’Ivoire” dated 18 December 2023, “Technical Report — Sissingué Gold Project, Côte d’Ivoire” dated 29 May 2015, and “Technical Report — Nyanzaga Gold Project, Tanzania” dated 10 June 2025 continue to apply.

Caution Regarding Forward Looking Information:

This report contains forward-looking information which is based on the assumptions, estimates, analysis and opinions of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of gold, continuing commercial production at the Yaouré Gold Mine, the Edikan Gold Mine and the Sissingué Gold Mine without any major disruption, development of a mine at Nyanzaga, the receipt of required governmental approvals, the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Forward-looking information involves known and unknown risks, uncertainties, and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any anticipated future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, the actual market price of gold, the actual results of current exploration, the actual results of future exploration, changes in project parameters as plans continue to be evaluated, as well as those factors disclosed in the Company's publicly filed documents. Readers should not place undue reliance on forward-looking information. Perseus does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

|

ASX/TSX CODE: PRU CAPITAL STRUCTURE: Ordinary shares: 1,350,988,737 Performance rights: 6,705,501 REGISTERED OFFICE: Level 2 437 Roberts Road Subiaco WA 6008 Telephone: +61 8 6144 1700 www.perseusmining.com |

DIRECTORS: Rick Menell Non-Executive Chairman Jeff Quartermaine Managing Director & CEO Amber Banfield Non-Executive Director Elissa Cornelius Non-Executive Director Dan Lougher Non-Executive Director John McGloin Non-Executive Director James Rutherford Non-Executive Director |

CONTACTS: Jeff Quartermaine Managing Director & CEO jeff.quartermaine@perseusmining.com Stephen Forman Investor Relations +61 484 036 681 stephen.forman@perseusmining.com Nathan Ryan Media +61 420 582 887 nathan.ryan@nwrcommunications.com.au |

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.